can you get a mortgage with unfiled taxes

Think about those monumental purchases you may make in your life. Long convoluted story Obviously I am working on these.

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

If you owe money and do not file your taxes the IRS will assess a failure to file penalty which is 5 of the back taxes owed per month the return is late up to a maximum of 25.

. Your lender may require official transcripts of your tax return which can take up to. Generally you will not be able to get a mortgage if you have unpaid taxes. Ad Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process.

At The W Tax Group we specialize in helping people who have unfiled tax returns and late taxes. You Can Struggle to Make Big Life-Changing Purchases. Heres the truth most lenders wont give you a mortgage if you have unfiled tax returns but it can be possible.

It explains why you generally need a tax return to get a mortgage how to get a mortgage with unfiled tax returns and what to do if your lender requires a tax return. This guide is for you. Choose Wisely Apply Easily.

They are hesitant to work with people who show signs of not meeting their financial obligations. Get Help with Unfiled Returns and Tax Bills. It depends on the specific lender and their policies.

This is the starting point preparing the last. As an agency within the Department of Housing and Urban Development FHA guidelines require full documentation of borrower income to qualify for a government-insured loan. In short yes you can.

If youre wondering Can I get a mortgage with unfiled taxes. Ad Best Home Lenders Compared Reviewed. Get Free Quotes From Reputable Lenders.

Not providing tax returns for getting a mortgage is not a recipe for granting a loan to consumer who has not filed a tax return. Then you should know its very possible. If you are someone who is contemplating the purchase of a home but have not filed your taxes or have missed the extension deadline have no fear.

Yes even if youve neglected to pay your taxes for a few years the IRS has a procedure for doing so. But failing to address your underlying debt with the IRS or state taxing authorities doesnt put you in the best spot for negotiating favorable loan terms. I am currently in the process of buying a home with an FHA loan.

It does not mean that you can wait several years. Ready for homeownership but worried about your unfiled returns. Special Offers Just a Click Away.

You can get expert help filing back tax returns with the IRS. You have six months. Generally you will not be able to get a mortgage if you have unpaid taxes.

Can I get a mortgage with unfiled taxes. In most cases the IRS requires the last six years tax returns to be filed as an indicator of being current and compliant. Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS.

Find Out When Rates Drop. Find the One for You. The reference is IRS Policy Statement 5-133 and Internal Revenue Manual 41213.

Having tax debt also called back taxes does not preclude you from qualifying for a mortgage by sheer virtue of having. Compare Your Best Mortgage Loans Calculate Payments. Can you get a mortgage with unfiled taxes.

Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution. In this post I cover everything you need to know about getting a mortgage without providing tax returns. A mortgage on the perfect house for your family.

The fraudulent failure to file is 15 percent up to a maximum of 75 of the back tax owed. In a nutshell your total bills are measured against your total income so adding a new bill like a tv or car can upset your ratio and your ability to get approved. Ad Compare the Lowest Mortgage Rates.

Compare Rates Get Your Quote Online Now. By leaving your tax returns unfiled youre giving them the go-ahead to hold onto your hard-earned money. Ad Americas 1 Online Lender.

Ad Best Mortgage Lending Options 2022. While you may not need to provide tax return you still however must file your returns and have them IRS validated. Unfiled tax returns IRS representatives filed as substitute returns for you will usually be adjusted to reflect the deductions and.

Our 4 step plan will help you get a home loan to buy or refinance a property. Contrary to popular belief getting a mortgage without tax returns is possible for self-employed borrowers and non-business owners alike. Can you get a mortgage without tax returns.

Even so you may hesitate to submit a mortgage application because you still owe the IRS a tax debtDiscover how unpaid taxes can impact your ability to buy a home and how lenders regard IRS debts when considering new mortgage applications. Can You Get a Mortgage if You Owe Back Taxes to the IRS. Compare 2022s 10 Best Mortgage Lending and Save.

Unfiled Tax Return Information HR Block. I became aware today that I have unfiled taxes for 2011 and 2012. We have a closing date scheduled for April 25.

FHA-approved lenders determine eligibility of borrowers co-borrowers and co-signers by reviewing their income through tax returns or tax transcripts covering the past two. On top of the failure to file penalty is interest. Not providing tax returns for getting a mortgage is not a recipe for granting a loan to consumer who has not filed a tax return.

It depends on the lender. Other scenarios include if you are not legally required to file tax returns you need not provide returns for getting a mortgage. Long convoluted story Obviously I am working on these taxes now in order to get into compliance with the IRS.

Here are 10 things you should know about getting current with your unfiled returns. Can you get a mortgage with unfiled taxes. This of course is based on the annual amount of your taxable income.

With the resurgence of the housing market more people are finding it easier to buy new homes. Other lenders will not give you a mortgage at all if you have any due taxes. Whether youre celebrating a new job or were just let go your mortgage could be denied.

By leaving your tax returns unfiled youre giving them the go-ahead to hold onto your hard-earned money. Again lenders want to be confident that you can repay the mortgage. If you file your taxes now you may still qualify for a loan.

Some lenders will allow you to get a mortgage with unpaid taxes as long as you have a plan to pay them back. Reviews Trusted by More Than 45000000. Your job status changed.

In short yes you can.

Shelita Hall S Seven Negative Results And Six Painful Consequences For Unfiled Tax Returns

Unfiled Tax Returns Tax Relief Attorney Fairfax Va Virginia Lawyer

When Tax Returns Are Not Filed If You Are Seeking Help Filing Current Tax Returns The Team Of Tax Professionals At Our Firm C Tax Return Tax Help Tax Attorney

If You Are Worried About Tax Related Issues Like Unpaid Taxes Or Unfiled Taxes In Florida Then Consult With A Best Filing Taxes Tax Preparation Tax Deductions

Irs Tax Debt Resolution Tax Preparation Tax Planning Accounting Firm Offer In Compromise Page Keith L Jones Cpa Tax Debt Irs Taxes Debt Resolution

Unfiled Tax Return Information H R Block

How To Qualify For A Mortgage With Unfiled Tax Returns

Non Filed Tax Returns Assistance Houston Texas Non Filed Irs Tax Returns

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

Why You Should Resolve Unfiled Taxes Before Declaring Bankruptcy

Unfiled Tax Returns Wasvary Tax Services Travel

Can I Get A Mortgage With Unfiled Taxes Tax Group Center

Can You Get A Mortgage With Unfiled Taxes It Depends Debt Strategists

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

Unfiled Tax Returns Unfiled Taxes Top Tax Defenders

Can I Go To Jail For Unfiled Taxes

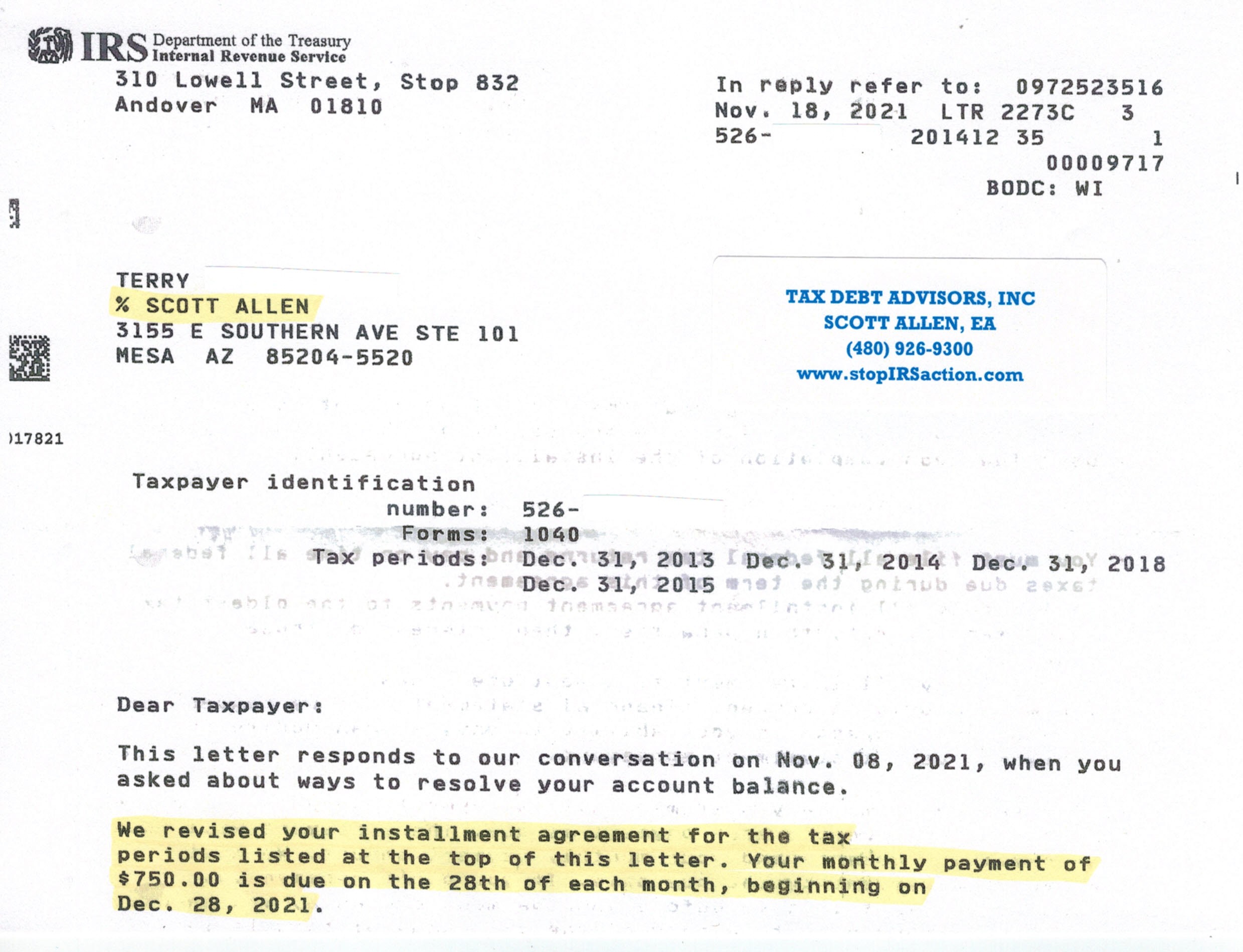

Unfiled Tax Returns Tax Debt Advisors

What Unfiled Tax Returns Mean For Chapter 13 Bankruptcy Debtors Loan Lawyers